Project

Company:

Itaú Unibanco

Employer:

BRQ

Role:

UX/UI designer

Workplace:

Remote

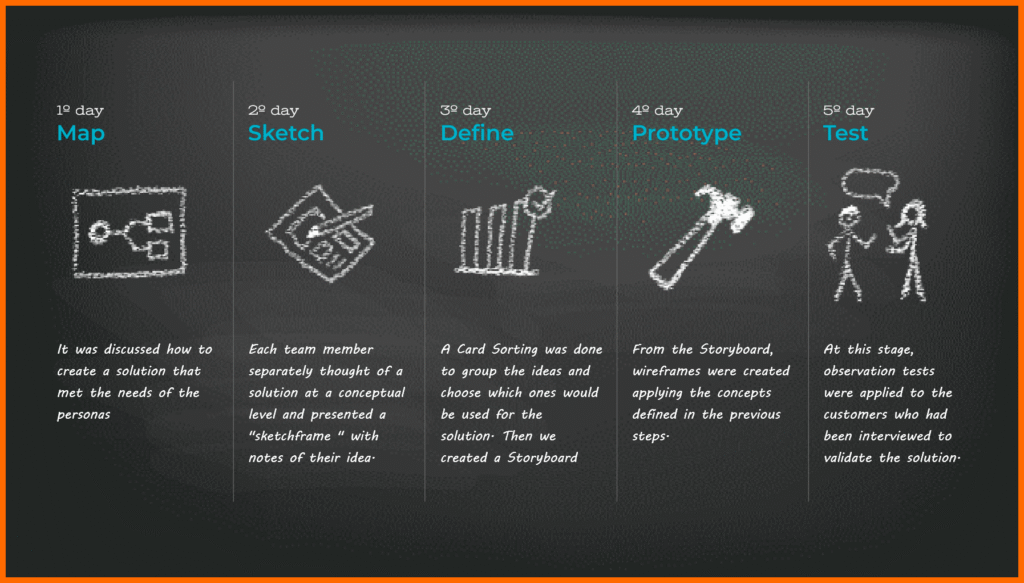

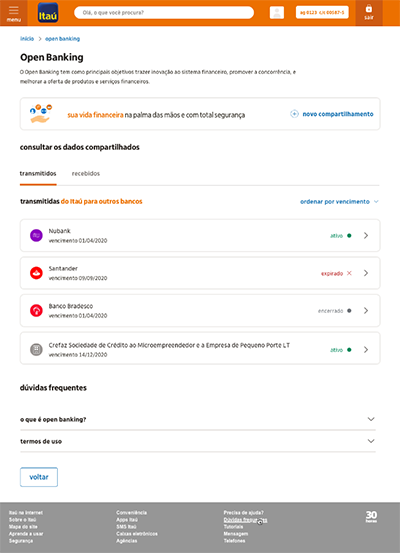

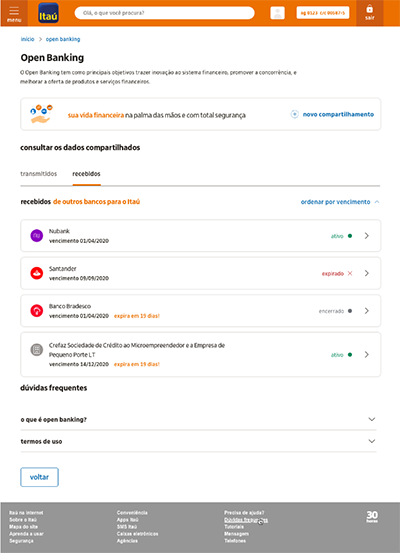

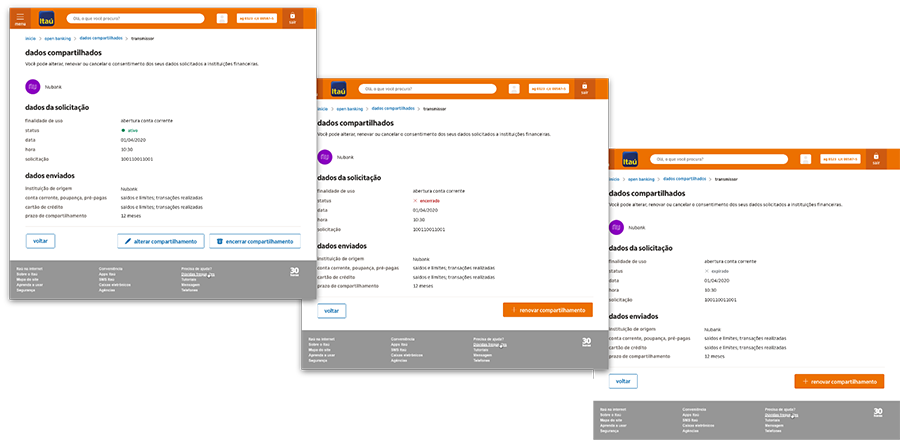

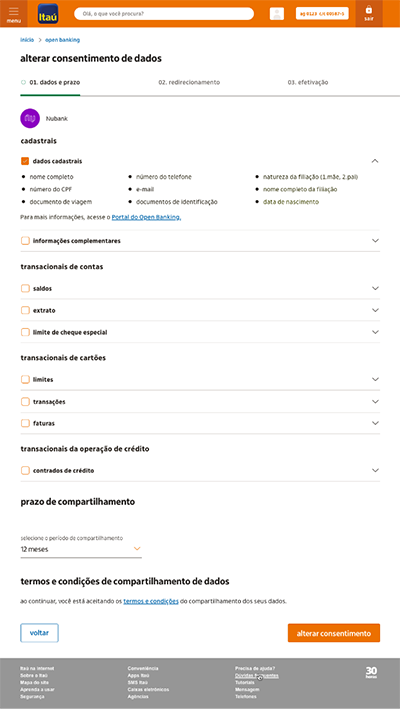

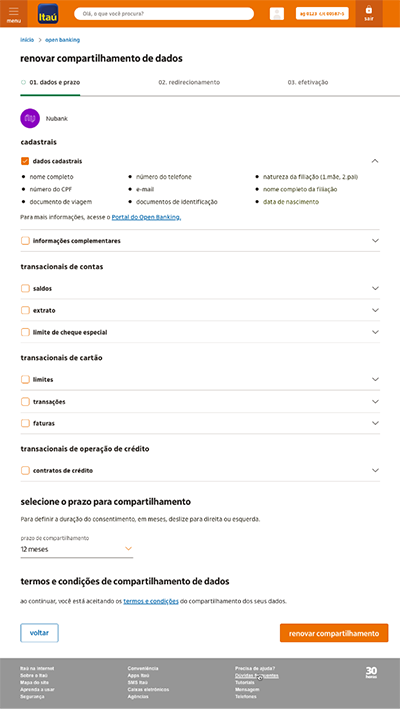

The Open Banking project emerged as an emerging demand from the Central Bank, which required the implementation of the LGPD (General Data Protection Regulation) in the financial sector throughout Brazil. This service allows customers to choose whether or not to share their banking data between financial institutions and which data they wish to share.

Create a solution that meets the central bank’s demands in accordance with Open Banking standards based on the LGPD (General Data Protection Law)

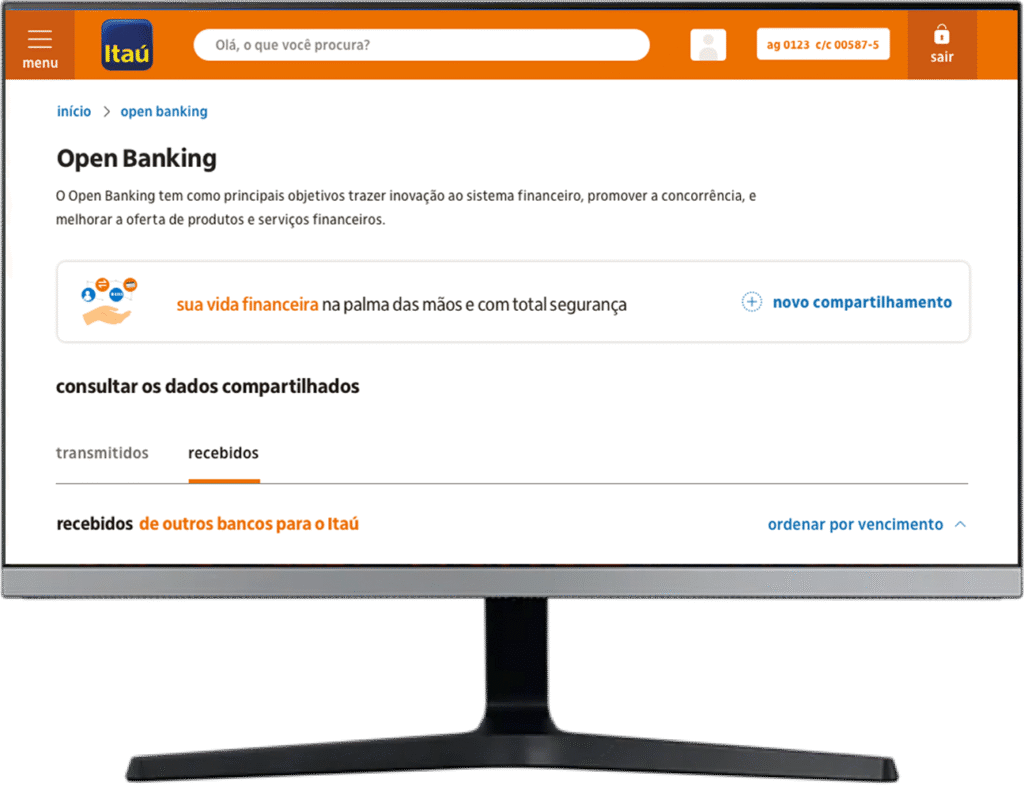

Due to the complexity of the problem presented, the project managers assigned a specific area to each team and a specific role to each designer to streamline the design process. I was assigned the Web/Desktop area, which focused on physical clients. Then, together with the design teams, the project leaders decided that we would adopt the Design Thinking method to design the solution.

The main pain points founded:

From the interviews we created proto-personas to facilitate understanding of the context of the problems to be solved.

Barbara is 26 years old, lives in Belo Horizonte – MG, has a boyfriend, works in sales at a startup and is studying marketing. Her time is extremely scarce because she has to divide it between: work, study, taking care of her cat, being with her boyfriend and taking care of household chores, as she lives alone. She enjoys and is comfortable with digital technologies, and intends to specialize in social media in another country after finishing college and for this she has meticulous financial planning. Although she currently does not have time for this, she seeks political and social awareness, thus having a skeptical and inquisitive mindset; which leads her to distrust large companies, including financial institutions.

Age:

26 years old

Education

Studying marketing

Lives in:

Belo Horizonte – MG

Marital status:

Single (in a relationship)

unskilful

proficient

skeptical

anxious/stressed

balanced

no time

unoccupied

carefree

strict control

Manoel is 67 years old, lives in Rio de Janeiro – RJ, is a retired mailman, but currently works as a carpenter because his retirement pension is not enough to cover his expenses due to his wife’s expensive medicines and treatments; Manoel recently found out that she will need to have a very expensive surgery but Manoel and his wife does not have medical insurance or money saved. He is a practicing Catholic and believes that God is in control of everything, which leads him to not practice strict control of his finances, but he tends to believe in the goodness of people.

Age:

73 years old

Education

High school

Lives in:

Rio de Janeiro – RJ

Marital status:

Married

unskilful

proficient

skeptical

anxious/stressed

balanced

no time

unoccupied

carefree

strict control

How do you rate Itaú’s transparency in sharing your financial and personal data?

3.7

How do you rate how easy it was for you to use the digital technologies of Open Banking services?

4.4

How practical and efficient was it for you to use Open Banking services?

4.1

4.07

17